Beneficial State Bank was founded in 2007 with a commitment to support social justice and environmental regeneration through triple bottom line banking. As part of its responsible business practices, the bank has measured and reduced its total and per-employee carbon footprint since 2012, and has purchased or retired carbon credits to offset its greenhouse gas emissions for Scope 1, 2, and part of 3 (business travel, employee commutes, purchased paper, water usage, waste, and shipping) each year.

But it is not enough to measure and offset these emissions alone. As a bank, Beneficial State recognizes that one of the most significant ways in which it impacts the world – both positively and negatively – is through its lending. As such, the bank is excited to participate in the PCAF initiative to develop protocols and measure the carbon footprint of its loan portfolio. As part of this initiative, the bank measured the carbon footprint of its consumer auto loan portfolio using the PCAF North America methodology.

Beneficial State Bank’s Clean Vehicle Access Program offers grants to low-income residents to purchase electric and hybrid vehicles. Beneficial has a consumer vehicle loan portfolio of approximately 8,000 borrowers, totaling $78 million in outstanding loans as of March 1, 2019. The bank also regularly purchases truck loans from a community development lender as part of a California Air Resources Board program to reduce the emissions of commercial trucks in California.

The bank’s consumer auto loan program serves low-income and credit-challenged individuals, primarily in California’s Central Valley where there is little to no access to public transportation. This program provides a more affordable and transparent alternative to current auto financing practices that pervade this market. The region is also burdened with the worst air quality in the nation, an environmental injustice that we address through our foundation’s Clean Vehicle Assistance program, which provides grants to help people purchase low- and zero-emissions vehicles.

While the bank’s auto loans provide critical and affordable access to transportation for tens of thousands of people for whom public transportation is not a valid option, Beneficial State Bank recognizes that this portfolio has a significant carbon footprint, which it seeks to measure and reduce.

Beneficial State Bank calculates the carbon footprint for all on-balance lending for the purchase or refinance of motor vehicles (cars, trucks, SUVs, and a small number of motorcycles, snowmobiles, and ATVs). Beneficial State Bank is the sole provider of financing for these loans, and therefore attributes 100% of annual emissions of those vehicles to itself.

Data for method 1: Loans for which Beneficial had vehicle make and model available (82% of portfolio)

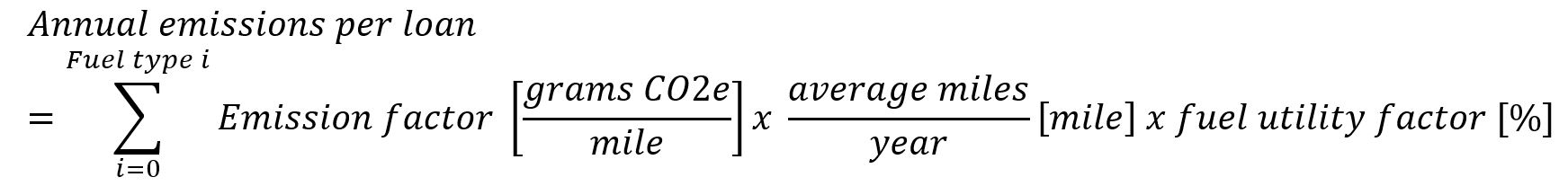

For all internal combustion engine vehicles:

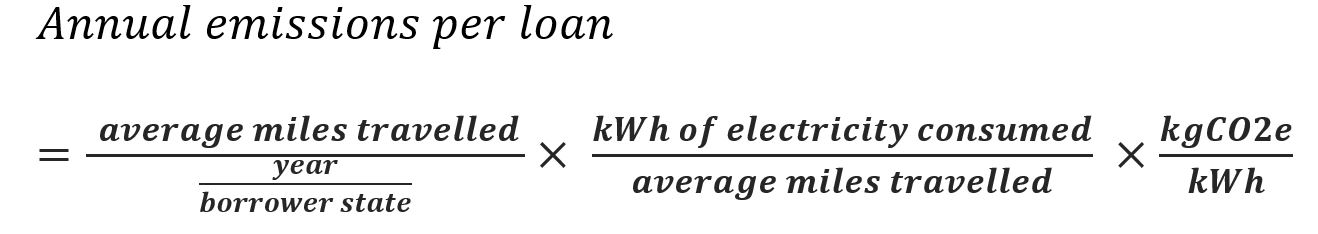

For Electric vehicles and plug-in electric vehicles:

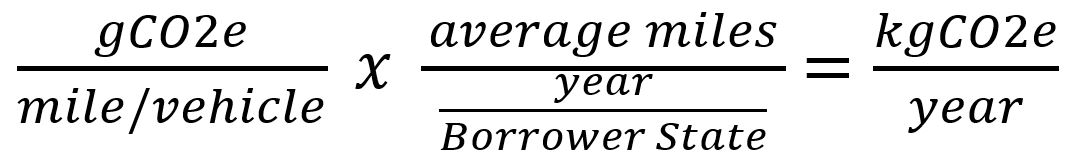

For all loans:

Data for method 2: Loans for which Beneficial do not have vehicle make and model available (18% of portfolio):

For all loans:

Calculations method 1:

Electric Vehicles (EVs)

Plug-In Hybrid Electric Vehicles (PHEVs)

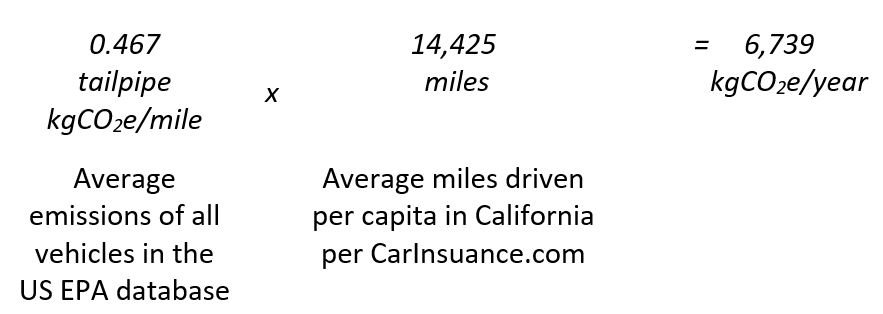

Calculations method 2

Single fuel non-EVs

An example calculation for a vehicle of unknown make, model, or year for a borrower in California would be calculated as follows:

Total absolute emissions for Beneficial State Bank Consumer Vehicle Loan Portfolio as of March 1, 2019: 47.9 million kg CO2e/year. Of this total, clean vehicles (hybrid, plug-in hybrid, and electric) account for: 1.1% of the portfolio and 0.49% of emissions.

Total relative (per $) emissions for Beneficial State Bank Consumer Vehicle Loan Portfolio as of March 1, 2019: 0.615 kg CO2e/year/dollar. The clean vehicle relative (per $) emissions are 0.25 kg CO2e/year/dollar.

Beneficial State Foundation administers a multi-million-dollar program from the California Air Resources Board that provides grants to low- and moderate-income Californians to purchase clean vehicles. Beneficial State will use this program to continually increase the proportion of its loan portfolio that goes to low- and zero-emission vehicles, thus continually reducing the carbon footprint of the portfolio, while contributing to cleaner air in some of the areas with the worst air quality in the country.

Beneficial State will also explore additional ways to encourage and incentivize customers to purchase cleaner vehicles through marketing, beneficial fees, interest rates, and terms, and to incentivize auto dealer partners to increase clean vehicle sales.